30+ Principal reduction calculator

With a 30-year fixed-rate loan your monthly payment is 125808. The amortization schedule shows equal principal payments and decreasing interest amounts.

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

The calculator prepares an investment schedule only if you have entered an extra payment amount AND if the option Include the Investment Schedule is set to Yes As.

. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. As an alternative to foreclosure a lender may. C the period interest rate which consits of dividing the APR as a decimal by the frequency of payments.

Make payments weekly biweekly semimonthly monthly bimonthly. Bank Has The Tools For Your Mortgage Questions. How much you originally borrowed to purchase your home.

The annual stated rate of the loan. Extra mortgage payment calculator. When you make extra mortgage payments youre reducing.

Suppose you get a 200000 home loan with an interest rate. Look at your lender statements as these. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information.

PL c 1cn 1cn-1 P the payment. What Is A Principal Reduction. Principal Payment Loan Calculator -- This Loan Calculator deals with a fixed principal and varying monthly interest payments.

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. When calculating the principal reduction amount of your loan it is important to consider the total.

This easy and mobile-friendly calculator will calculate a 30 decrease from any number. The principal is the amount. The size or value of the loan.

Initial loan amount. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. For example a loan.

Free fast and easy to use. Results are based on the assumption that the original mortgage repayment period is 30 years. To qualify borrowers had to be at.

Calculate your home mortgage debt and display your payment breakdown of interest paid principal paid and loan balance. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Calculating Principal Reduction Conclusion.

Our Resources Can Help You Decide Between Taxable Vs. L the loan value. Use it as an interest only loan calculator.

Just type into the box and your calculation will happen automatically. A principal reduction PR is a reduction in the amount owed on a loan most often a mortgage. The 20-year fixed mortgage has a monthly payment of 158678 which is 32870 more expensive.

The Principal Reduction Modification program was a one-time program announced by the Federal Housing Finance Agency FHFA in 2016. Number of payments over the loans lifetime Multiply the number of years in your loan term by.

Loaddocument Php Fn Reitsblogchart Png Dt Fundpdfs

Loaddocument Php Fn Exhibitb2022globalequityoutlook Png Dt Fundpdfs

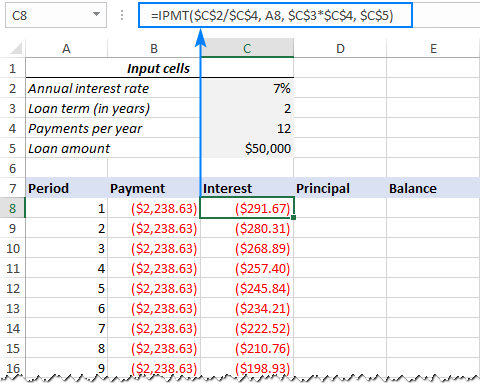

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

What Is The Excel Formula For A Mortgage Quora

Financial Independence Report April 2022 Financially Alert

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

2

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Loaddocument Php Fn Agencymbs0419ex5 Png Dt Fundpdfs

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Loaddocument Php Fn Focusvaluer1vtor1g0425 Png Dt Fundpdfs

Ex 99 1

Insights Eaton Vance

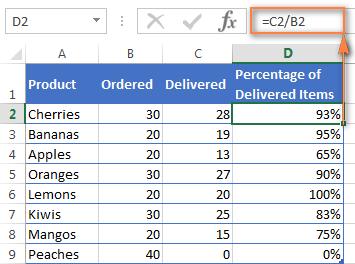

How To Calculate Percentage In Excel Percent Formula Examples

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed